real estate market crash

At the height of the housing crash and. Consider the housing crash in 2007.

|

| Will The 2022 Housing Crash Be Worse Than 2008 Youtube |

Fannie Maes housing market forecast released in September 2022 is also less bullish due to softening consumer spending.

. Everyone is feeling the squeeze. Millennial Demand for Housing is Up With Gen Z Right Behind. The monthly supply of houses determines how long it will take for. After house prices rose by 22 per cent last year Australias property market is running out of steam.

As a result of these policies a shockingly large price bubble appears to have formed in the real estate market. Supply versus demand. They anticipate the greatest year-over-year decline in house sales at the customary peak of the summer selling season. Housing markets are more localized and regional and can trend in opposite directions in different locations or states.

The first step in preparing for a real estate market crash is to familiarize yourself with your local real estate market. Most housing experts are predicting the market to remain strong for a while for several reasons. Excess inventory is one of the most significant indications of a housing market crash. Crashes in the real estate market arent nearly as common as people may think.

Aside from the Great Recession real estate prices actually rose in the dot com bubble and the. The average sales price of a home in the fourth quarter of 2021 was. Housing prices nationwide have increased 485 percent since 2010 with the average cost going from 173000 to. Into recession just like it did in 1981 and 2008.

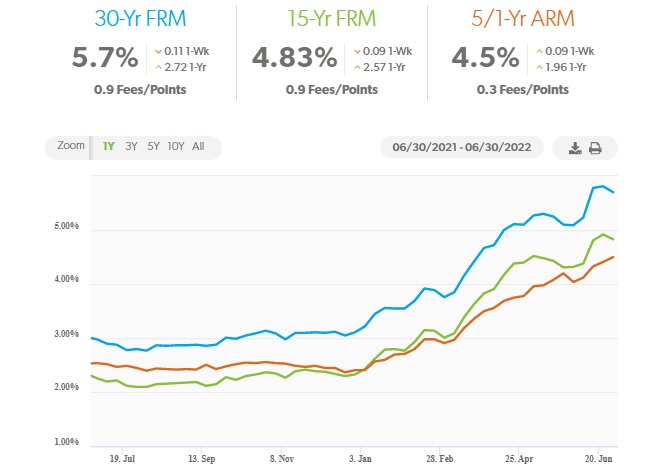

The federal interest rates in 2022 are still below the levels they reached in 2007 prior to the housing crash. 9 Houses Stock Surplus. Get in touch wi. The most notable crash of the 1900s took place in 1929 with the crash of Wall Street leading to the Great Depression.

Federal government began selling off land in the year 1800. Why the Australian housing market is finally ready to crash. 4 2022 500 am. The increase in inventory is not because more people are selling but because.

First the big picture. Mortgage rates have hit a 20-year high as the Fed tries to fight. The ESR group lowered their 2022 forecast for. Its november 2022 now and we have already seen a slight crash in housing prices.

While the real estate market is certainly cooling off in many parts of the country most experts agree that we are not headed for a repeat of the 2008 crash. Pay attention to trends over time so that you can identify any. This is looking more like a real estate crash than a correction And yet prices are remaining reasonably sticky particularly in the central core. Mortgage rates are sky high prices are sky high and theres no inventory said Mark Zandi the chief economist at.

Housing market activity is crashingand it threatens to push the US. This is s a broad based term for the real estate industry. October 25 2022 906 AM UTC. Google Trends shows that search queries for real estate market crash have skyrocketed in the last month.

RenoFi predicts that number will hit 1048100 in 2030. What is going to happen to the real wstate market in 2023. Since then there have been peaks and valleys of land sales and speculation roughly. As a result of the crash prices fell up to 67 with properties.

Mortgage Interest Rates Are Low. Jeffrey Chubb the Chubb Homes Team Brokered by eXp Realty. Historically real estate has proven very resilient with median home prices declining in just eight of the past 60 years.

|

| Premium Photo Real Estate And Construction Crisis Real Estate Market Crash Due To Recession Economic Downturn Crisis Arrow To Down And Model House On Blue Background Copy Space |

|

| Housing Market Crisis 2 0 The Jury Is In For 2018 2019 Seeking Alpha |

|

| Will The Housing Market Crash Experts Give 5 Year Predictions Axial Financial Group |

|

| Us Housing Market Crash Coming Mortgage Professional |

|

| Dick4fftdcufdm |

Posting Komentar untuk "real estate market crash"